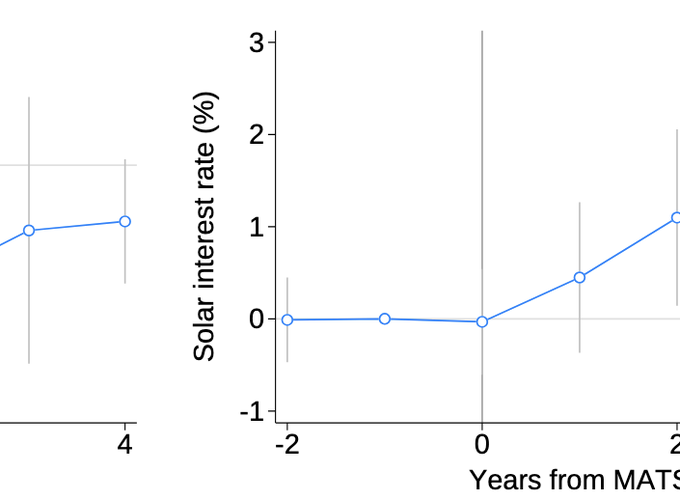

Investments in electricity generation capacity incur substantial upfront costs and produce uncertain returns that can take years to materialize, making them highly dependent on external finance. We link loan-level regulatory data to power plant-level generation capacity and use two natural experiments to examine how financial frictions affect electricity producers' responses to taxes and subsidies. We find that increasing the cost of coal generation created spillovers through firms' internal capital markets and ultimately reduced investments in new solar capacity. We also find that subsidies designed to increase cash flows to early-stage projects disproportionately boosted solar capacity investments for financially constrained firms. These results highlight the importance of firms' financial frictions in understanding how policy can influence investments in electricity generation.

Blonz, Howes and Weill (2025)

Blonz, Howes and Weill (2025)