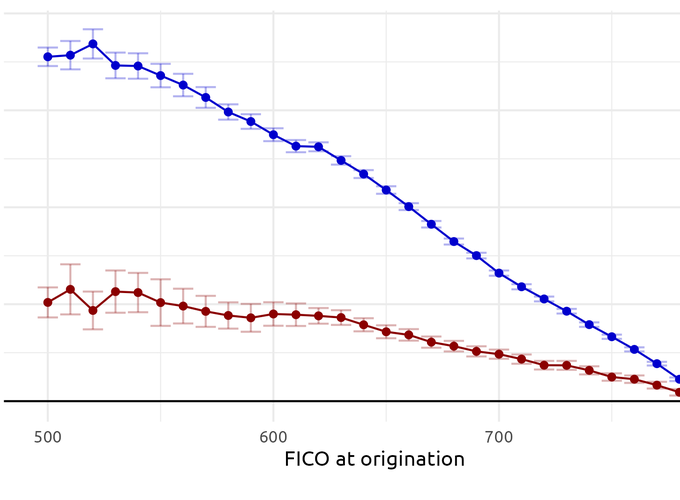

This paper leverages novel data on 15 million home insurance policies to understand how credit scores and natural disaster risks affect the price of home insurance. We find that individuals with subprime credit pay 30% more for home insurance than individuals with super-prime credit. These differences are not explained by property or contract-level characteristics, and likely reflect how insurers use credit score to price anticipated future claim filing behavior. Leveraging a house-level match with a proprietary disaster risk model, we find that the passthrough of expected annual disaster losses is close to one on average, higher than one for individuals with lower credit scores, and below one in high insurance-regulation states like California. We show that despite a passthrough rate for disaster risk close to one, disaster risks account for less than a quarter of premiums on average, and around a third in high-risk states like Florida and Louisiana. These findings reveal that at the policy-level, the disaster risk component of insurance prices is on average smaller than the discount given to people with high credit scores. Insurance prices often depend more on who lives in a home than on the disaster risk a home is exposed to.

Figure by Joakim A. Weill

Figure by Joakim A. Weill